British Hints for the Ukrainian National Energy and Utilities regulatory Commission

Many misunderstandings about dynamic increasing electricity and heat prices for the final consumers in Ukraine remain on the same stage – the open question of the Ukrainian society and energy experts’ communities – why Ukrainians should pay for the index, which de facto is not applied in the final price of produced electricity and heat?

In the UK, consumer may pay nothing until he gets the full explanation and justification. In Ukraine, so called "market prices" are nothing just burden for Ukrainians, but in the UK – this is a justified prospect of service quality and infrastructure for all.

The questionable acting of the Ukrainian National Energy and Utilities Regulatory Commission (NEURC) more and more attracts the attention of the public. However, despite the attempts to defend their policies made by the management, some issues remain unclear, for instance: API 2 index (benchmark price reference for coal imported into northwest Europe; in Ukraine it is usually called "Rotterdam plus" i.e.API2 price plus shipping), RAB (Regulatory Asset Base) regulation (it is also called Regulatory Asset Value, RAV) etc.

Being engaged in energy expertise I would like to know the details as well. Having visited the United Kingdom lately, I had the opportunity to talk with the representatives of UK government regulator for the electricity and downstream natural gas markets in Great Britain, called The Office of Gas and Electricity Markets (OFGEM).

There were 5 specific questions I asked to get more information, both for myself and, I hope, the broader Ukrainian public. Below there are brief but I think very clear information which allows us to see the how UK energy regulator works and to evaluate which features the Ukrainian National Energy and Utilities Regulatory Commission (NEURC) can borrow.

The specific/fundamental rules which make competition on the UK gas and electricity market transparent and dynamic?

There is Competition and Markets Authority (CMA) in the UK. The CMA is a non-ministerial government department in the United Kingdom, responsible for strengthening business competition and preventing and reducing anti-competitive activities. The CMA launched in a shadow form on 1 October 2013 and began operating fully on 1 April 2014, when it assumed many of the functions of the previously existing Competition Commission and Office of Fair Trading, which were abolished.

As it is the highest competition body in the Great Britain (GB), OFGEM asked it to investigate the energy market, as they were concerned that despite several major programs of reforms were introduced, the market was still not working as well as it should be for consumers:

- The CMA has found that customers have been paying £1.4 billion a year more than they would in a fully competitive market.

- The CMA is also introducing a range of measures to revitalize competition and reduce the costs borne by customers. These include pressing ahead with reforming outdated systems for measuring and charging energy that distort competition between suppliers, reducing the costs of transmitting electricity and using competition to help ensure that financial support for low carbon generation is allocated at the lowest cost to customers. Price comparison websites (Price comparison websites, PCWs) will also be enabled to play a more active role in helping customers find the best offers for them and given access to meter data which will enable customers to search instantly for deals.

As it is said, "The CMA has concluded its energy market investigation setting out a wide range of reforms to modernize the market for the benefit of customers.

There is full report after its investigation of the GB energy market, made during 2014-2016.

Schedule of rates: efficiency and approaches (the OFGEM policy of prices and tariffs on the gas and electricity markets. Are there any specific conditions on which you making your policy of prices and tariffs for regular customers and business?)

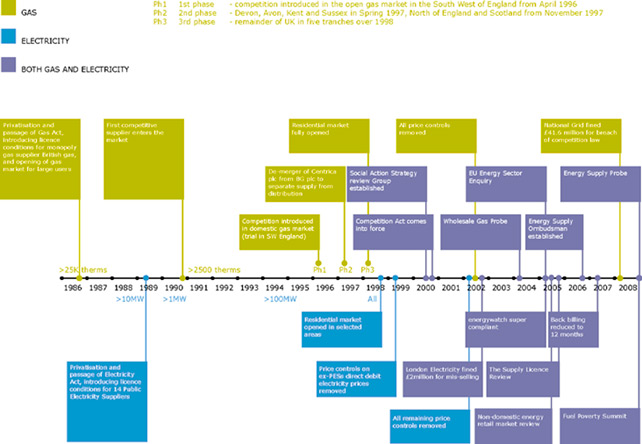

OFGEM doesn’t use price controls, or set prices for retail tariffs in the GB. The privatization process (when energy supply/generation was taken out of public ownership and put into the hands of companies) started in 1986/89 for gas and electricity. The ultimate aim was for customers to be able to choose their energy supplier, and for suppliers to compete for customers by undercutting the price of their rivals. By the late 1990s competition in retail supply was rolled out across the GB and around 2002 the price controls on retail supply of energy were fully lifted. On the Figure 1 we can see the timeline for privatisation and when the retail price controls were lifted:

The part of the market where OFGEM do use price controls is in transportation of energy (through the pipes and wires). That’s because the companies that own these networks tend to have more of a monopoly. (For example, it is unlikely that anyone will build an entire new national electricity grid in the GB to compete against the existing one). These price controls are currently set over an 8 year period where OFGEM decides the maximum revenue the network companies can earn, looking at their spending plans. OFGEM agrees with them the outputs that they must deliver for customers set the incentives which penalise/reward them depending on how they perform, and OFGEM sets their cost of capital.

RAB on gas and electricity markets – how is RAB forcing the gas/electricity market development. Are there any disadvantages in RAB?

NEURC wants to implement RAB-tariff. Government will not back the introduction of RAB method of tariff regulation, as it might affect bills for consumers.

On the RAB issue – unlike the Ukrainian regulator we do not set retail price tariffs in GB. RAB is one of the components of the price controls we set for GB network companies.

The meaning of regulated asset base, which in the GB energy sector refers mostly to the value of the assets that network companies hold.

RAB usually refers to the measure of the net value of a company’s regulated assets used in price regulation. It drives two of the fundamental building blocks that make up the company’s revenue requirements: the return on capital (i.e. the return on the RAB) and the depreciation allowance. It is a key determinant of prices that may be charged for regulated services in the future (according to the http://www.inogate.org/documents/Energy%20pricing%20in%20EU%20ENG.pdf).

Could be the issue of security of gas and electricity supply in UK be as an example for Ukraine?

GB has one of the most reliable electricity systems in the world, and high standards of security of supply have been maintained even though margins for generation supply over demand have fallen as older (mainly coal fired power stations) have closed. OFGEM took steps to ensure National Grid (the high-voltage grid system operator) could manage the risks by allowing them to use New Balancing Services (where they procured extra reserve power from power stations, and demand side response services from industry.) Those measures were in place until last winter (2016-2017). From winter 2017-2018 the Government’s Capacity Market takes over as the longer term incentive for power stations to provide security of supply.

More about electricity security of supply here: https://www.ofgem.gov.uk/electricity/wholesale-market/electricity-security-supply

Generally, gas security of supply has been less of an issue compared with electricity in GB. There are diverse supplies in GB and OFGEM is not reliant on any one source for gas.

Are there any possible ways of the OFGEM assistance and help in reforming and modernizing Ukrainian NERC?

On advising the Ukrainian regulator – OFGEM could only consider this it gets an official request from NEURC.

To my mind, as GB has one of the most reliable electricity systems in the world, it is obvious and would be reasonable for NEURC to initiate such a request.

Mykola Voytiv

Head of the NGO "New Generation Management", MBA